About Benjamin Doolittle U.E.

Benjamin Doolittle UE is a Lower Mohawk of Grand River and a direct descendant of the Mohawk Loyalist leadership that secured the Haldimand Tract. In his capacity as Secretary-General for the Mohawk Nation of Grand River, he works to uphold the hereditary rights and responsibilities carried by his line. Through his matrilineal line, he descends from Esther Springstead (Shatekariwate), a clanmother married to Captain David Hill, U.E.L.

Matrilineal line:

Tracey → Beverly → Mabel → Bertha → Lydia → Esther → Ellen (daughter of Isaac Brant) → Mary → Esther Springstead (Shatekariwate)

This makes Benjamin a sixth-great-grandson of Joseph Brant U.E.L. (Thayendanegea) and Isaac Brant of Canajoharie, one of the three named Mohawk villages carried into the Grand River settlement. Band Council has certified that he holds 100% Mohawk blood quantum under their rolls, reflecting both his hereditary standing and his rootedness in the community.

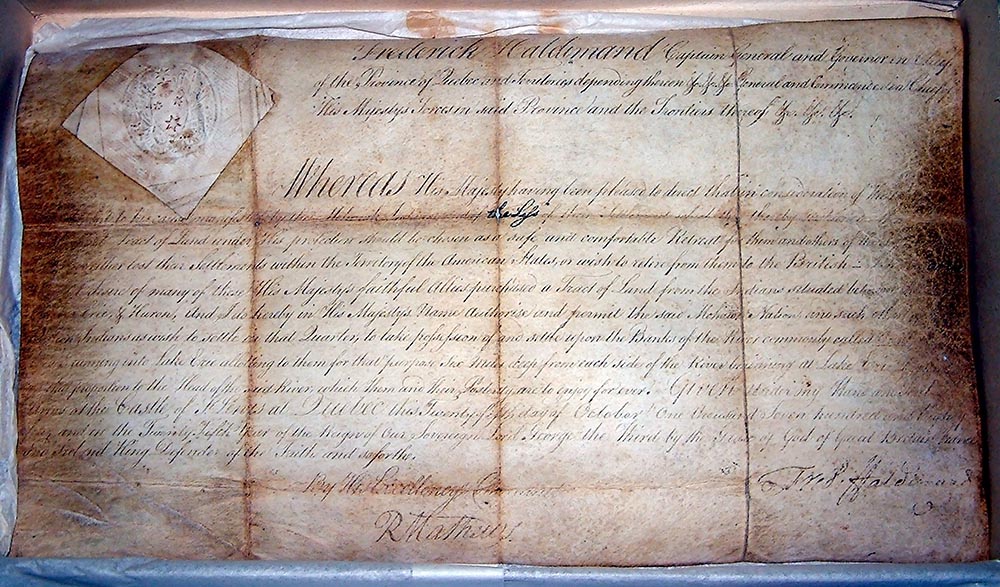

In his role as Secretary-General, Benjamin’s work with Six Miles Deep focuses on recovering and enforcing the original Crown-recognized framework for Mohawk title along the Grand River — not as a generic “aboriginal rights” claim, but as a specific hereditary interest grounded in Loyalist service, the Haldimand Proclamation, and the subsequent Crown instruments that confirmed it.

Beyond Six Miles Deep, Benjamin has founded and developed several initiatives to strengthen Mohawk continuity and stewardship, including Grand Back, the Bluebelt conservation concept, Mohawk University, and the Kanien’kehà:ka Language Development Institute. Together, these projects aim to restore land-based governance, protect the Grand River watershed, and support language and cultural renewal for Mohawk posterity.

Earlier in his career, Benjamin operated a community photo studio for several years, specializing in weddings, newborn, and family portraits across the Grand River region. He later helped launch the Indigenous newspaper Two Row Times, supporting its development as a platform for Onkwehonwe voices and treaty-based perspectives.

Benjamin is also an independent music producer, releasing work under the name One Way Current, published by Corn Press Publications. Through his music and writing, he explores Mohawk history, land, and spiritual continuity in contemporary forms that speak to both youth and elders.

He is a member of the United Empire Loyalist Association of Canada, the Royal Heraldry Society of Canada, and the Monarchist League of Canada. These associations reflect his conviction that Crown honour, hereditary recognition, and proper heraldic and historical process are essential to resolving the long-ignored duties owed to Mohawk posterity on the Grand River.

Benjamin maintains an active working relationship with ministers, local officials, and church representatives, regularly greeting dignitaries and visitors at the Mohawk Chapel and using those encounters to remind them of the Crown’s ongoing duties to the Mohawk Nation of Grand River.

Benjamin is also a survivor of the Indian Day School system, an experience that informs his understanding of how imposed systems of education, identity, and governance have tried to overwrite Mohawk continuity while leaving the underlying treaties and Crown obligations intact. His lived experience sits alongside his archival research, legal studies, and community work, grounding Six Miles Deep in both documentation and reality on the ground.

Through Six Miles Deep and related projects, Benjamin works to:

re-establish lawful recognition of Mohawk hereditary rights along the Haldimand Tract

clarify the distinction between band-council trust structures and the underlying Mohawk title

educate institutions, governments, and the broader public about the continuing force of Crown promises to the Mohawk Nation of Grand River

His goal is not simply to revisit history, but to restore living jurisdiction, stewardship, and continuity for Mohawk posterity, “six miles deep” on both sides of the Grand River, in a way that honours both the ancestors who secured the land and the children who will inherit it.